Aero Asset Reports 2025 Twin-Engine Helicopter Sales Sink to Five-Year Low, with APAC Defying Downturn

Report notes retail sales reach five-year low, steady supply for sale, firm median pricing, and bullish growth in Asia-Pacific.

TORONTO, ONTARIO, CANADA, September 15, 2025 /EINPresswire.com/ -- Aero Asset, a global helicopter sales and market intelligence firm, released its 2025 Half Year Heli Market Trends Twin-Engine edition. Powered by proprietary market insight, this report delivers a comprehensive analysis of the global preowned twin-engine helicopter market, providing insight for industry stakeholders.

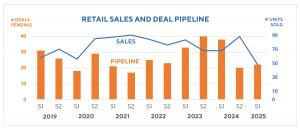

The report tracks activity across weight classes, configurations, regions, and highlights trends in sales, supply, pricing and liquidity. For the first half of the year, the data revealed that twin-engine sales activity dropped sharply: only 49 twin-engine helicopters sold to retail buyers between January and June — a 33% drop from 2024 and the weakest performance in five years.

"Global sales hit a five-year low, but supply held steady — and Asia-Pacific bucked the downturn with bullish momentum ," said Valerie Pereira, Vice President of Market Research.

Pricing:

Supply of twin-engine helicopters for sale was stable year over year (YOY) with a drop of 3%. “Supply remains relatively low, only 23% higher than its lowest point in the last five years”, said Valerie Pereira. Absorption rate rose to 22 months of supply at current trade levels. Median transaction price (MTP) climbed 7% YOY, with light and medium twins up 10% YOY, and heavy twins reaching a five-year high.

Weight Class Performance:

The declining retail sales trend was evident across all weight classes. Light twin-engine sales fell 37% YOY, with supply steady. Medium twin retail sales dropped to a five-year low, and supply hit its lowest point in five years. Heavy twin sales fell to their lowest level in five years, supply surged 43% YOY.

Regional Trends:

Market activity shifted geographically in the last six months. Supply for sale was concentrated in Europe (36%) and LATAM (26%), followed by North America (19%) and Asia-Pacific (APAC) (14%). By contrast, the North American market accounted for the largest share of transactions (39%) with APAC (25%) Europe (16%) and LATAM (14%). APAC posted the only YOY retail sales increase during the first half of 2025 (+71%), whereas sales in Europe declined 68%.

Liquidity:

The Airbus EC/H145 and Bell 429 markets performed best during the first six months of 2025. The Leonardo AW109S/SP and Sikorsky S92A markets were strong contenders, while the Airbus EC/H225 and EC/H155 markets continued to struggle with absorption rates exceeding three years.

Download 2025 Half Year Heli Market Trends Twin-Engine Edition:

Aero Asset’s Heli Market Trends series is a benchmark reference for the preowned helicopter industry, trusted by operators, financiers, and OEMs worldwide. Visit aeroasset.com/report to download the latest report with all its data, analysis, and an exclusive interview of Junia Hermont, CEO of Líder Aviação.

###

About Aero Asset Inc.:

Aero Asset is a global aircraft sales and market intelligence firm, headquartered in Toronto, Canada. With decades of experience trading aircraft worldwide, the company is a leading provider of aircraft remarketing, acquisition and advisory services.

Aero Asset is a member of Vertical Aviation International, National Aircraft Finance Association, the European Helicopter Association, HeliOffshore and the National Business Aviation Association.

For more information about the company, its inventory for sale, services and industry reports, visit https://aeroasset.com.

Pierre Bled

Aero Asset

+1 732-578-8217

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.